Saral2D_IncomeTaxReturnSoftware2003

Saral2D_IncomeTaxReturnSoftware2003

We are proud to present the Income-Tax Return (ITR) Filing Software, named "Saral 2003 Spreadsheet" that had been created by us in the year 2002-2003 for filing the ITR's done by one of our clients who used it to file almost 100-150 of their clients. Needless to say, we used the same software to file the ITR's of our own clients too!

So basically it consisted of a single Excel Workbook that was used to store all the data related to a particular client and one could save it as another excel file, by renaming it, say for example the original file was called "Saral2003SpreadSheet.xls", you could save it as "XYZ_Saral2003SpreadSheet.xls". Since there was just one version of the file that was in circulation, there was no problem of there being any "Missing Updates", because that would happen only after that round of ITR Filing was completed.

When you opened the file, you would see the worksheet containing the Menu, as shown below:

In the above figure, there were only the buttons given that would call the relevant routine to open the userforms, show the required worksheet, or to quit the program completely. Since this software was our first attempt at VBA Programming, you may find that some of the interfaces given were also quite amateurish, but the important thing to remember is that put together, it worked!!

The first button that says "Enter Data" would be clicked only when the data entry of the assessee and th relevant ITR data was to be entered. Data Entry was done by using 14 basic userforms, named UserForm01 to Userform14 respectively. The first userform that would appear when the "Enter Data" button was clicked, and it looked like the figure below:

The 13 pink buttons on the right hand side represented the 13 other userforms that would be called when you clicked the repective button. The names on the buttons were created to give the user an idea of which soft of data would be fed using that form. The first userform, obviously, was for collecting basic data of the Assessee, like Name, Father's Name, DOB etc. and also the basic data related to that particular Assessment Year, in this case it was AY 2003-2004 relevant to the Financial Year Ended 31-March-2002. The data that you see on the screen is obviously the data related to the programmer, in this case, yours truly.

The second userform is as set out below:

This userform collected the information related to the Office Address, Banking information and Credit Card Information that was used to fill the Saral 2D ITR form.The Third Userform is:

In those days, the Saral 2D form was meant for those entities who would have Salary Income and / or Business Income, along with the other heads of Income, so this form sought to collect the income details as existing in the Form 16 (Salary Income).

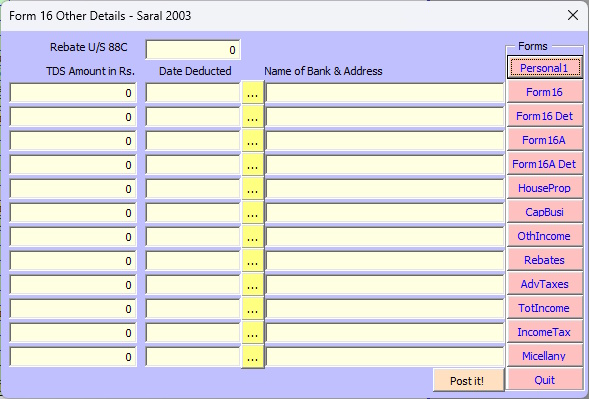

Fourth UserForm:

Quite obviously this userform collected other details found in the Form 16 like Tax Deducted at Source, Date deductd and the Name and Address of the bank deducting the TDS. This form contained the yearly information, so therefore 12 months data of TDS Deducted from the Salary Income would be collected here.

Fifth Userform:

This userform collected information related to the first Form 16A of the assessee.Sixth Userform:

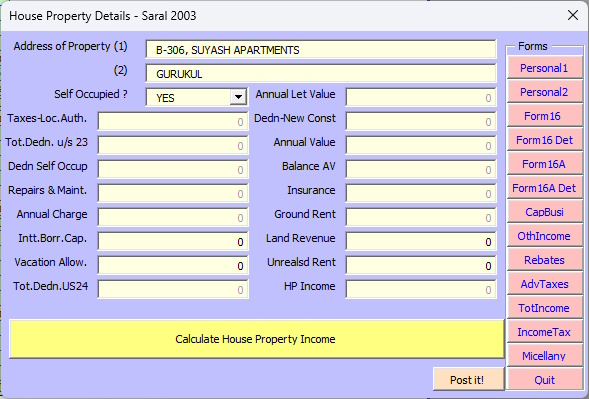

This userform collected information related to the second Form 16A of the assessee.Seventh Userform:

This userform collected information about the House Property, if any, claimed by the Assessee, wherein the House Property could either be Self-Owned or Deemed Rented Out, etc.Eighth Userform:

This userform collected information relating the the Assessee's Capital Gains income, Short Term (STCG) and Long Term (LTCG) seperately. Computation of Business Income also began with this userform, so that there was conservation of space and resources too.

Ninth Userform:

This userform collected the information regarding the Income From Other Sources, including Interest from National Savings Certificates, if any, possessed by the assessee.Tenth Userform:

Details of the Deductions and Rebates under the Section 88 / 88A of the then Income-Tax Act, 1961 were to be entered here. The buttons just before the pink buttons on the right were provided to perform the necessary checks, as required by the Act and the Rules framed thereunder.

Eleventh Userform:

Details of Advance-Tax during the four quarters, Interest U/S 234A/B/C where presented here for review and changes, if any. Notice the yellow buttons showing the three dots? They were to be used to enter the data in the userform (globally, throughout the entry of data).

Twelfth Userform:

This userform would be called after all the relevant information regarding the ITR was completed, and would therefor show the Computation of Total Income of the assessee, where the necessary iformation pertaining to another person, agricultural income and income claimed exempt could be entered and then the final position could be reviewed.

Thirteenth Userform:

This userform presented the Computation of Income-Tax for the Income presented for taxation pertaining to the said Assessee for review and for approval, prior to generation of the Saral 2D ITR.

Fourteenth Userform:

This userform would allow the Miscellaneous Information pertaining to the assessee to be entered, for printing in the Saral 2D form to be printed and readied for submission to the Income-Tax Department.

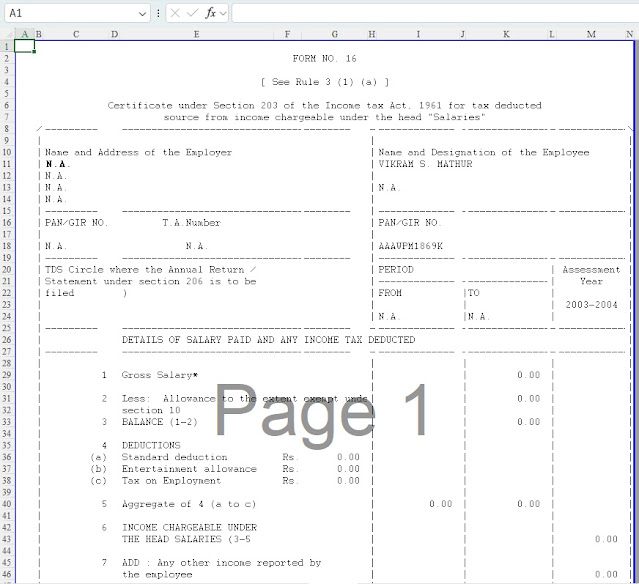

Once all the fourteen userforms were filled, the Saral 2D form would be ready to be submitted after being printed. The Worksheet that stored the Saral 2D form, would look like this:

Of course, the above is only a screenshot of the worksheet, not the worksheet iself, and is presented here only for the purpose of illustration. The information that was entered in the userform(s) would get posted to the worksheet, when you would click on the button called "Post-It" present on all of the userforms presented above, which you can review.

The Computation of Total Income, which also contained the Computation of Taxes for the Assessee would be stored on a worksheet called "Computation" as shown below.

Again, the full worksheet does not appear here, since it is a screenshot, and is meant to show you how the information is stored on the worksheet, again onm clicking the "Post It" button.The Form 16 and the two Form 16A worksheets are shown below, as screenshots.

Then there was the worksheet that would store information regarding the National Savings Certificates and the interest there on, as below.

Finally, there was the Control Worksheet that would store information that would be used to calulate the total income, total taxes, capital gains and house property details.

We would also like to share three other userforms that were used in the workbook, as below:

(a) Date Entry Userform:

The history behind this userform is quite interesting. The VBA interface earlier had a UserControl (OCX) that allowed you to place the Control on a userform directly which offered a dropdown date. But soon after the 64 bit version of MSOFfice was introduced, Microsoft removed that DatePicker.OCX and Calendar.OCX Controls from the VBA Interface. This gave us developers some pain for some time, however, there was enough support from the VBA Developers globally, and we were able to follow those informations to develop our very own SelectedDate Userform, as shown above.

(b) Saral 2003 Options Userform:

As is obvious from the Userform above, it allowed you to make the Control Worksheet visible, where one could review the information entered using the 14 userforms above, and make changes (using the userforms only, not directly, for the worksheet was protected). The Date Selected could also be changed here, even though the same was stored on the Control Workheet itself. Rebate amount U/S 88 C and the Surcharge %age applicable could also be changed here.(c) Business Profit Range Userform:

To bring the Net Profit as per the Annual Accounts (Oh, by the way, you had to manually enter the Balance Sheet and Profit and Loss Account with the Fixed Assets Schedule in the worksbook itself) into the calculation of the Total Income, you could specify which cell contained the Net Profit taxable in the ITR.And, finally the Control Worksheet, shown as a screenshot below, is not the entire worksheet, because there was too many sections of it to screenshot, is below:There were two other pieces of the software, that were contained in the workbook, those are:

(I) About Author Userform:

In the above userform, the information (as per those times) was presented to the user, and it could be called from the Menu itself, when you clicked the bottom-most button showing the address of the developer. And finally, if you clicked any blank portion of the above userform, or the address on the userform, you got the :

(II) WhatsNew03 Userform:

Obviously, the future versions of the software were deemed useless, because the ITR software itself underwent a drastic change sometime after AY 2006-2007, so the Visual Basic 6 software never really happened, and unfortunately for us, our prime user also passed away around that time.We got busy with a lot of other things around then, and development went on in other fields of interest, so this was the end of the Saral 2D software.

Thank you for the patient reading that you have done about our Saral 2D software.

CA Vikram Shankar Mathur

vsmathurco@gmail.com

vikramsmathur@gmail.com

+91-9998090111 / +91-8460890111